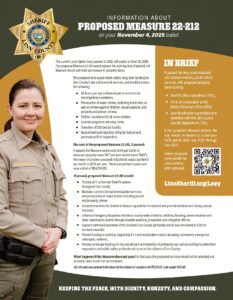

Proposed Measure 22-212: Four Year Local Option Law Enforcement Tax Levy

On November 4, 2025, Linn County voters will have the opportunity to vote on a proposed four year local option levy measure which would cost $3.08 per $1,000 of assessed property value.

Download our informative single page guide to the Linn County Law Enforcement Levy, Ballot Measure 22-212.

This proposed measure would replace the existing law enforcement levy, would begin in July, 2026, and last for four years. The proposed Linn County Law Enforcement Levy would continue funding for County public safety and law enforcement services if passed. These services include the Sheriff’s Office, District Attorney’s Office, and the Juvenile Department.

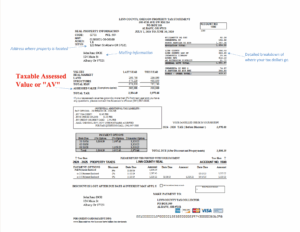

The current law enforcement levy is at the tax rate of $2.98 per $1,000 of assessed property value (this is different than the real market value “RMV”). If passed, the proposed levy would increase the rate to $3.08 per $1,000 of assessed property value “AV”. The owner of a home with an assessed value of $250,000 (not market value) would see an increase of $25.00 annually from the expiring levy rate (or approximately $2.08 more per month).

Please also review the Explanatory Statement filed with the Linn County Clerk’s Office.

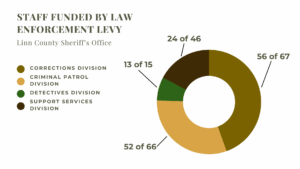

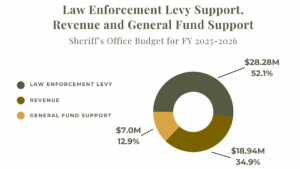

The Linn County Sheriff’s Office has a full staffing allocation of 195 positions. The law enforcement levy, making up 52.1% of the resources for the Sheriff’s Office, funds 145 of 195 positions within the Sheriff’s Office – or 74%. The remainder of the positions are paid for out of the General Fund, and grant funding.

For more than 42 years the Sheriff’s Office has relied upon the voters to approve a levy to operate the Sheriff’s Office and maintain services. In fiscal year 2025-2026, the law enforcement levy funding makes up $28.28M of all funding for the Sheriff’s Office, or roughly 52.1%.

For more than 42 years the Sheriff’s Office has relied upon the voters to approve a levy to operate the Sheriff’s Office and maintain services. In fiscal year 2025-2026, the law enforcement levy funding makes up $28.28M of all funding for the Sheriff’s Office, or roughly 52.1%.

Frequently Asked Questions

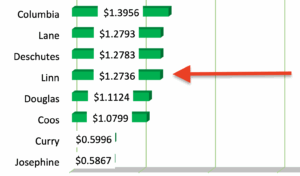

The Assessment and Taxation Office is responsible for assessing all properties in Linn County. This includes commercial, industrial, residential, farm, forest, manufactured structures and business personal property. Each October property tax statements are distributed to property The Oregon Department of Revenue has an informative article titled Real Property Assessment and Taxation that provides a detailed explanation of these topics. The current levy, at a rate of $2.98 per $1,000 of assessed property value, was approved by voters in November, 2021. It went into effect July 1, 2022 and expires June 30, 2026. The proposed levy would replace the existing levy, and if approved by the voters, go into effect on July 1, 2026 for four years, expiring June 30, 2030. The current law enforcement levy is at the tax rate of $2.98 per $1,000 of assessed property value (this is different than the real market value “RMV”). If passed, the proposed levy would increase the rate to $3.08 per $1,000 of assessed property value, an increase of $0.10 per $1,000. For a home with an assessed property value of $250,000, the increased rate would cost an additional $25.00 annually from the current rate. In Oregon, voter-passed measures that limit property tax revenue include Measure 5 (1990) and Measure 50 (1997). Together, they have shaped Oregon’s property tax landscape by controlling tax rates and limiting increases in property values for tax purposes. This levy maintains, and enhances, existing public safety services, with revenues funding operations of the Sheriff’s Office (76%), criminal prosecution at the District Attorney’s Office (10%), plus juvenile offender supervision and detention with the Linn County Juvenile Department (14%). The proposed levy would provide funding for Linn County’s law enforcement services, and would maintain the following: If passed, proposed measure 22-212 would: If the proposed measure 22-212 does not pass, the proposed services would not be provided and the tax rate would not change. The General Fund is the primary operating fund supporting Linn County governmental operations like the County Assessor’s Office, Surveyor’s Office, County Clerk, Board of Commissioners, and many other county departments. The Sheriff’s Office, like other county departments and offices, received a small portion of the General Fund, that coupled together with other funding sources and revenue allow for the full operation of the organization. The General Fund resources from the County, allocated by the Budget Committee and the Commissioners, makes up 12.9% of the Sheriff’s Office budget. It is worth noting the Permanent Tax Rate (set in place in 1997 by Measure 50) for Linn County is $1.2736 per $1,000 of assessed property value. This is the fifth lowest rate of all 36 counties in Oregon. Click the graphic to see the full chart. Download our informative single page guide to the Linn County Law Enforcement Levy, Ballot Measure 22-212. Anyone with questions are invited to reach out to the following people regarding the Four Year Local Option Law Enforcement Levy. Michelle Duncan, Linn County Sheriff Doug Marteeny, Linn County District Attorney Linn County Board of Commissioners owners. To find your taxable assessed property tax value, you can click on our helpful guide, as well as search for your property online.

owners. To find your taxable assessed property tax value, you can click on our helpful guide, as well as search for your property online.

Phone: 541-967-3825